By: Naledi Mashishi

June 13 2024

Those who use alternative Sharia law-compliant property financing schemes are still required to pay taxes, including stamp duty

Context

A Facebook post dated June 9, 2024 (archived here) claims that Muslims who buy property in the U.K. can bypass paying stamp duty because "the government put special rules in place just for them!"

The post claims that because paying interest is a sin to Muslims, the U.K. government has set up "special rules" that allow Muslims to avoid paying stamp duty by getting a middleman based overseas to buy a house for them and lease it back to them. It claims that the middleman will transfer the property back and that both parties will avoid paying stamp duty in the process.

"I'm not saying that every Cousin is not paying Stamp Duty, I'm saying that a special system just for them exists and that it has been and can be abused," the post continues. In this context, "Cousin" is used as a derisive term for Muslims, which refers to marriage between first cousins being permissible in Islam.

It then ends with a quote credited to Sultan Choudhury, former CEO of Al Rayan Bank, stating, "It was certainly not envisaged that some tax advisers would manipulate the legislation on behalf of their clients to avoid paying stamp duty at all."

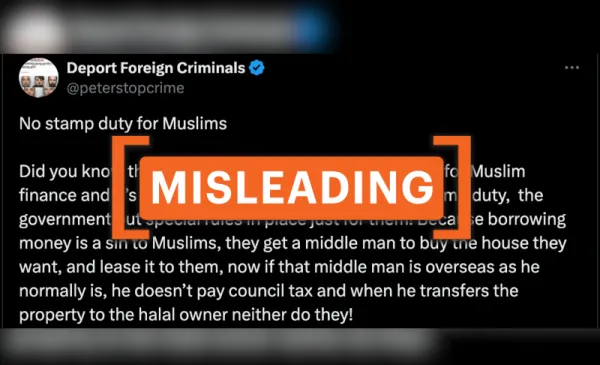

The claim has also been posted on X (archived here).

The post uses a real statement published by The Times in March 2011 about non-Muslims exploiting Islamic finance schemes to avoid paying tax. However, it misrepresents how Sharia law-compliant alternative mortgages work. The government has not put "special rules" in place just for Muslims, and Muslims who use Islamic finance schemes to purchase property still need to pay stamp duty.

In fact

Stamp Duty Land Tax (SDLT) is a type of tax paid when purchasing property or land over a certain price in England and Northern Ireland. The tax also applies when a property is transferred in exchange for payment. SDLT must be paid within 14 days of closing on a property.

The Islamic faith forbids paying or receiving interest. Therefore, traditional mortgage schemes in which a borrower takes out a loan to pay for a house and pays it back with interest are forbidden for Muslims.

Alternative mortgage schemes that are compliant with Sharia law exist. The main types used for residential properties are Ijara, which involves making monthly payments that are part rent and part capital to finance the house, and Diminishing Musharaka, which is a joint-purchasing agreement between a homeowner and a bank in which the bank's ownership share of the property decreases as the homeowner makes monthly payments.

According to an article published by The Times on March 20, 2011, non-Muslim property buyers found a legal loophole in which they could use Islamic financing schemes to avoid paying SDLT on homes that cost more than £500,000. They would do this by immediately selling the property to an offshore company and paying that company rent rather than interest. They would then combine that with a pre-existing exemption for commercial properties to avoid paying the SDLT altogether.

The article estimated that the Treasury lost approximately £40 million per year on SDLT avoidance schemes, including those exploiting Sharia law-compliant schemes.

At the time, a spokesperson for HM Revenue & Customs (HMRC) said to the Times, "We are aware that a number of stamp duty avoidance schemes are being marketed. HMRC is actively addressing the risks posed by these schemes, using its inquiry powers to investigate their use."

In 2013, HMRC introduced changes that required property buyers to declare any SDLT that was outstanding to close the loophole that buyers were using to avoid paying the tax.

Logically Facts has contacted HMRC for comment but said it could not do so now as it is pre-election season in the U.K.

Islamic alternative mortgage schemes still require the homebuyer to pay SDLT, among other relevant taxes. Many banks in the U.K., such as Al-Rayan Bank, offer Sharia-compliant property financing schemes. Importantly, these schemes exist to avoid paying interest, but taxes — like SDLT —are still paid.

Under current laws, non-U.K. residents who purchase residential property in England and Northern Ireland not only pay SDLT but also pay a two percent surcharge known as the "non-resident surcharge." The law allows those using Islamic financing to be granted an exemption from SDLT, but only in cases where "the alternative financial provider pays SDLT when they buy the property under the arrangements."

The verdict

A viral post on Facebook and X claims that Muslims can avoid paying taxes when they buy a property because the government has given them a "special system just for them" that they can exploit. However, the claim misrepresents an article that is over 10 years old, and current laws require those who use Sharia law-compliant property financing schemes to pay stamp duty. We have, therefore, rated this as misleading.