By: Devika Kandelwal

August 26 2020

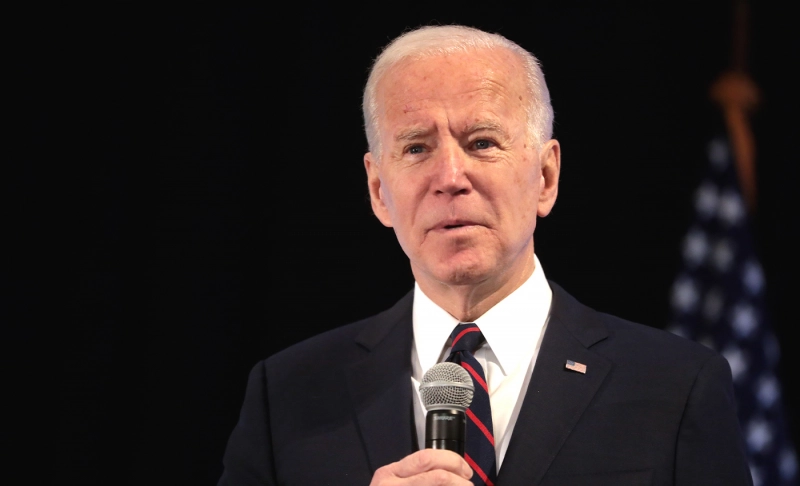

Biden wants to increase taxes on high-earning people and on corporations. His tax proposals would increase federal revenues by $4 trillion in 10 years

Biden wants to increase taxes on high-earning people and on corporations. His tax proposals would increase federal revenues by $4 trillion in 10 years In his tax policy, Joe Biden said he would generate about half the money of the $4 trillion, by raising taxes on households with incomes over $400,000 and the other half by raising business taxes. His individual tax hikes include increasing income tax rates and applying the Social Security payroll tax to those making $400,000 or more. He would limit the benefit of itemized deductions to 28 percent. He would tax capital gains and dividends at ordinary income tax rates for those making $1 million or more, and tax unrealized capital gains at death. At the same time, he’d raise the corporate income tax rate from 21 percent to 28 percent. The Tax Policy Center’s analysis of Biden’s tax policy shows that the top 1 percent would pay three-quarters of the tax hike. When Eric Trump said that Biden wants to raise taxes by $4 trillion during the second night of the Republican National Convention, he implied that this tax burden would fall across a range of incomes, whereas the detail of the plan reveals that it's primarily a tax on the 1%. Moreover, Joe Biden has clearly stated that tax will not be raised for people earning $400,000 or less. Furthermore, according to the Politico/Morning Consult survey of 2019, 76% of registered voters want the wealthiest Americans to pay more and support raising taxes. A Fox News survey from 2019 showed that 70 percent of Americans favor raising taxes on those earning over $10 million — including 54 percent of Republicans.