By: Sandesh M

September 27 2022

The Tax avoidance and evasion figures are presented based on assumptions rather than reliable data.

Context:

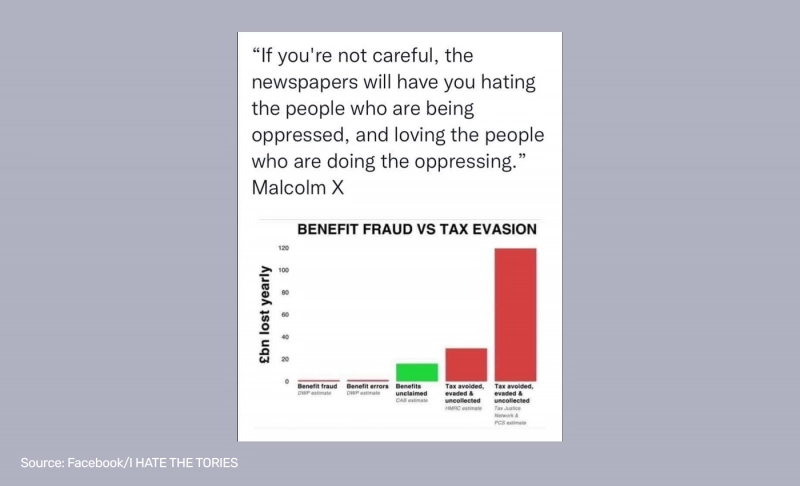

A Facebook post claims tax evasion is a larger problem than benefits fraud. It alleges that right-wing politicians use faulty assessments to make people believe those benefit receivers and immigrants are the real culprits. The post is accompanied by a bar graph showing that "tax avoided, evaded and uncollected tax" is ten times more than the combined figure for unclaimed benefits, fraud, and errors. The graphic shows a huge red bar touching £120 billion, supposedly lost annually in unpaid taxes. However, the figures are inaccurate. The post has received more than 250 likes and has been shared many times.

In fact:

The government's estimates show that it loses more money to tax evasion, avoidance and criminal activity than to benefit fraud. Exactly how much more money is not easy to estimate, due to the way they count and categorize these losses.

The U.K.'s tax agency HMRC estimates the tax gap – or the gap between taxes owed and taxes collected – for 2021 to be £32 billion, or 5.1 percent of all tax liability. HMRC emphasizes that while these estimates have been reached using the best data and methods available, these figures are uncertain and subject to revision.

The graph in the Facebook posts presents the HMRC estimate as entirely due to tax crimes, which is incorrect. About £12.2 billion is due to various kinds of shady dealings – £5.5 billion to tax evasion (deliberate attempts to under-declare taxable income), and £1.5 billion to tax avoidance (technically legal ways of bending tax law to obtain advantages that weren't intended by those laws). Criminal activity, which includes VAT fraud or smuggling taxable goods, accounts for £5.2 billion.

The remaining £20 billion is made of a combination of factors, including businesses becoming insolvent and being unable to pay, errors and carelessness when both individuals and businesses do their accounting, and also to the "hidden economy," or sources of income that HMRC does not know anything about and can only estimate.

The Department for Work and Pensions (DWP) estimates that in the fiscal year 2021-2022, £8.6 billion was paid as overpayments, and fraud amounted to £6.5 billion. The error levels in the benefits system were estimated at £2.2 billion. Notably, fraud linked to Universal Credit money has increased dramatically during the last two years of the pandemic. The BBC reported that roughly £15 billion of benefits are unclaimed yearly. It is impossible to calculate the exact figure for unclaimed benefits.

The £120 billion tax gap figure comes from a 2013 estimate prepared by Tax Research U.K., an independent pressure group run by the accountant and political economist Richard Murphy. HMRC criticized Murphy's analysis as flawed, saying that he relies on inaccurate estimates of the size of the hidden economy, counts legal sources of tax planning as tax avoidance, includes tax that does eventually get collected, and dramatically overestimates the VAT tax gap with incorrect data.

The verdict:

Tax evasion and avoidance together cost the U.K. £7 billion last year. Adding in criminal activity brings that total to £12.2 billion. Benefits fraud cost the U.K. £6.5 billion last year. These estimates are imperfect and subject to change over time.

The £120 billion tax gap figure comes from a 2013 independent report that the government criticized as inaccurate. While both HMRC and Murphy admit that tax gap estimates are not "an exact science,” Murphy's count is not any more definitive than HMRC's, depends on a variety of disputed estimates, and does not have the same access to tax data that HMRC does. Accurately counting the tax gap is both beyond the scope of this fact check and Logically's ability.

The original post intends to draw attention to the way that the financial crimes of wealthy and poor people are treated differently. Although it seems tax evasion and fraud outweighs benefit fraud, a clean comparison isn't really possible due to shifting estimates and different ways of adding it up. We rate this claim as misleading.