By: Karin Koronen

July 10 2024

Source: Facebook/Screenshot/Modified by Logically Facts

Source: Facebook/Screenshot/Modified by Logically Facts

The U.K. chancellor did not state that individuals earning over £30,000 and contributing to a pension for 30+ years will lose their state pension.

Context

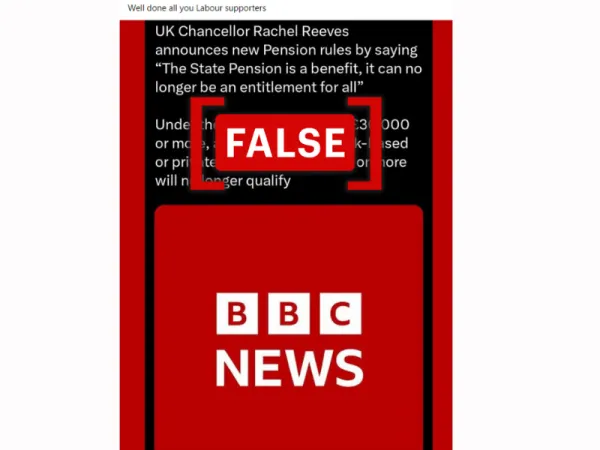

Posts circulating on social media (see archived examples here, here, and here) claim that Rachel Reeves, the new Chancellor of the Exchequer of the U.K., has announced new pension rules stating, "The State Pension is a benefit; it can no longer be an entitlement for all." Some posts also add that under the new Labour government, those earning £30,000 or more and paying into a work-based or private pension for 30 years or more will no longer qualify for a state pension. Several of these claims also feature a photo of the BBC logo.

However, the claim is false, and Reeves has not made any such statement.

In fact

This is not the first time claims about Rachel Reeves and Labour's intentions regarding pension policies have circulated on social media. In early July 2024, Prime Minister Keir Starmer stated that Labour would not raise taxes for “working people," leading to speculation about potential impacts on pensioners and others relying on savings. Reeves later clarified that “...working people are people who get their income from going out to work every day, and also pensioners that have worked all their lives and are now in retirement, drawing down on their pensions.” She and Starmer explicitly stated that they do not plan to raise taxes for pensioners, among other working people.

The Labour Party's manifesto explicitly states its intention to review the pension landscape but does not cover many specific implementation details. Labour aims to increase investment from pension funds in U.K. markets by adopting reforms that encourage workplace pension schemes to consolidate and scale. This approach is intended to yield better returns for U.K. savers and promote productive investments in U.K. companies. The party also pledges to maintain the State Pension triple lock, meaning that retirees could see a state pension of almost £13,250 per year by 2030. Furthermore, Labour addresses inequalities faced by mineworkers, promising fairer pensions. Their plans include granting new powers to the Pensions Regulator to intervene when schemes do not provide sufficient value.

In addition to Labour’s manifesto, public interviews and analyses have shed light on their pension policies. A review published by AJ Bell shows that while Labour pledged no increases to income tax in its manifesto, the party plans to keep the tax thresholds frozen, effectively enabling a covert rise in taxes. The party also planned to reintroduce a cap on how much people can save into their pensions before paying taxes, but according to the BBC, they dropped the idea because of potential uncertainty for savers and the complexity of reintroducing it.

There are no records of Reeves claiming that "The State Pension is a benefit; it can no longer be an entitlement for all." There is also currently no proof that Labour’s policies will mean that those earning £30,000 or more and paying into a work-based or private pension for 30 years or more are unqualified for a state pension. Labour hasn’t issued an official statement on this topic. Moreover, in her first official speech as a chancellor on July 8, 2024, Reeves mentioned pensions only briefly, stating, “And we will turn our attention to the pensions system, to drive investment in homegrown businesses and deliver greater returns to pension savers.”

In light of these claims, Logically Facts asked Labour to clarify their pension policies, which they did not comment on, and Reeves also did not respond to our request for comment. The BBC neither confirmed nor refuted that these statements originate from their website but instead instituted that if something has not come from an official BBC social account, one cannot assume it’s BBC journalism.

The claim has also been debunked by Full Fact.

The verdict

Rachel Reeves did not say that "The State Pension is a benefit; it can no longer be an entitlement for all," and Labour has not stated that those earning £30,000 or more and paying into a work-based or private pension for 30 years or more will no longer qualify for a state pension. Both of these claims are inaccurate, so we have marked them as false.