By: Varun Kumar

December 2 2020

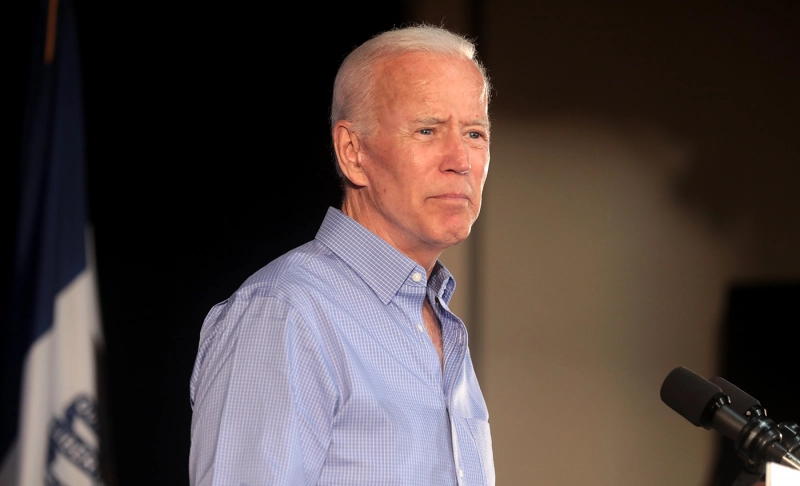

Joe Biden's tax plan includes a raise in taxes on individuals with income above $400,000 and also a raise in the corporate income tax rate.

Joe Biden's tax plan includes a raise in taxes on individuals with income above $400,000 and also a raise in the corporate income tax rate. Joe Biden, the president-elect of the United States, while addressing a campaign event on Jun. 18, 2019, at the Carlyle Hotel in Manhattan, said that wealthy donors had nothing to fear. He added that income inequality was a problem that must be addressed. He said that under his presidency, no one’s standard of living would change. He also said that he would not introduce any new legislation to change corporate behavior or rein in corporate power. Speaking about income inequality to approximately 100 donors, Biden said that he'd found that rich people are just as patriotic as poor people. The event was hosted by Eric Mindich, CEO and founder of Eton Park Capital Management. However, Biden's tax plan includes policies that primarily affect the rich. According to the tax plan he released before the election, he would enact several policies that "would raise taxes on individuals with income above $400,000, including raising individual income, capital gains, and payroll taxes. Biden would also raise taxes on corporations by raising the corporate income tax rate and imposing a corporate minimum book tax," noted the Tax Foundation. The Biden tax plan by 2030 would lead to about 7.7 percent less after-tax income for the top 1 percent of taxpayers and about a 1.9 percent decline in after-tax income for all taxpayers on average.